Debt-to-Income (DTI) Ratio

All the things you need to know before applying for a mortgage

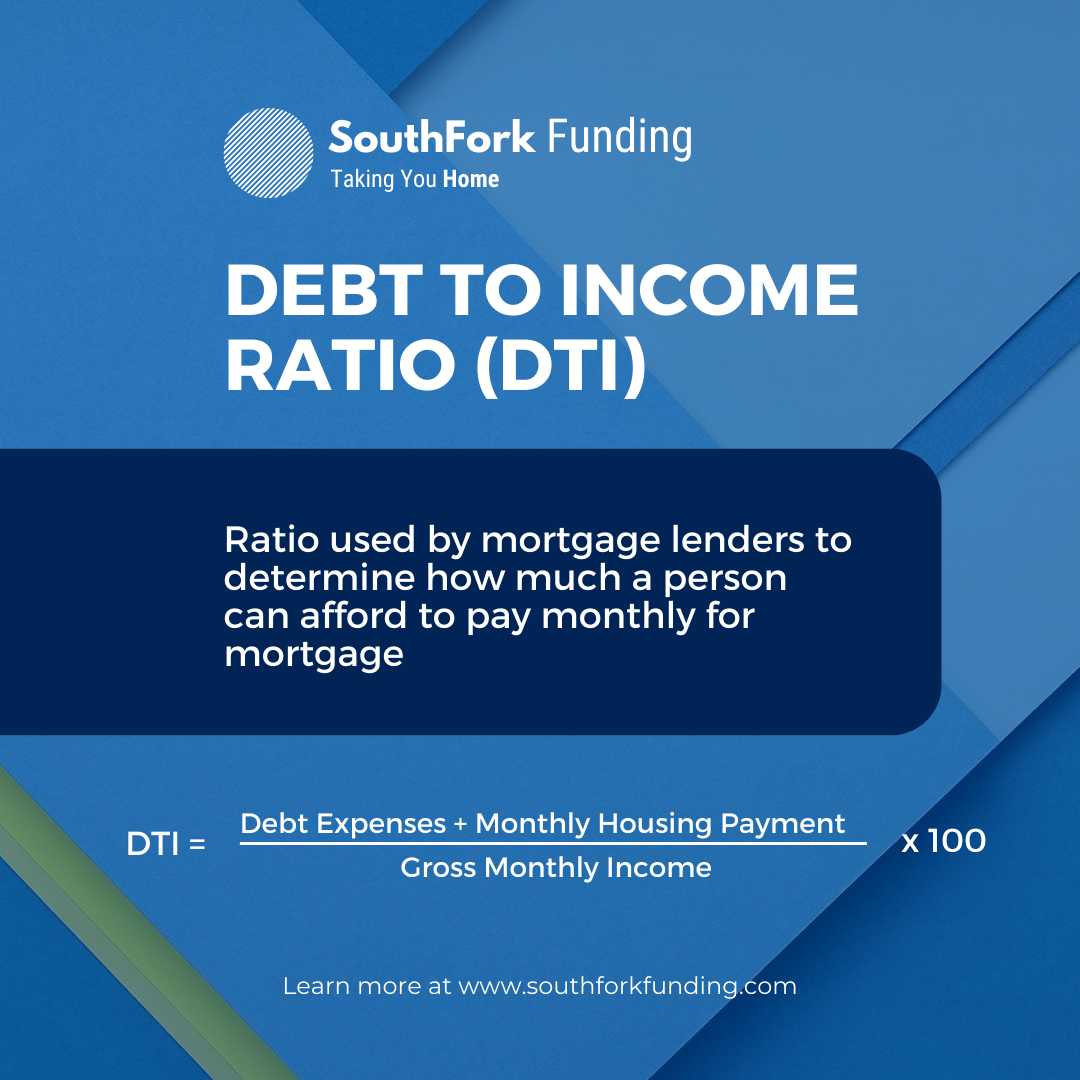

What is Debt to Income Ratio? (DTI)

Lenders assess your borrowing risk using your debt-to-income (DTI) ratio, which is the proportion of your gross monthly income that is utilized to pay your debts each month.

How It Works:

A low debt-to-income (DTI) ratio indicates that debt and income are well balanced. In other words, a DTI ratio of 15% indicates that 15% of your total monthly income is used to pay off debt. In contrast, a high DTI ratio can indicate that a person has too much debt relative to their monthly income.

Borrowers that have low debt-to-income ratios are typically better able to handle their monthly loan payments. As a result, before offering a loan to a potential borrower, banks and financial credit providers prefer to see low DTI percentages. Since lenders want to make sure a borrower isn't overextended, or has too many debt payments relative to their income, they want low DTI ratios.

The maximum DTI ratio a borrower can have and still get approved for a mortgage is 43% as a general rule. Lenders want a debt-to-income ratio that is less than 36% and one where no more than 28% of that debt is used to pay a mortgage or rent.

The maximum DTI varies depending on the lender. The borrower's prospects of being authorized, or at least given consideration for, credit are, nevertheless, better the lower the debt-to-income ratio.

Calculating Your Debt-To-Income Ratio

The debt-to-income (DTI) ratio is a personal finance metric that contrasts a person's monthly gross income with their monthly debt payment. Your salary before taxes and other deductions is known as your gross income. The percentage of your monthly gross income that is used to pay off debts is known as your debt-to-income ratio.

Example:

Debt-to-Income Ratio Example

Bob is looking to get a loan and is trying to figure out his debt-to-income ratio. Bob's monthly bills and income are as follows:

Mortgage: $2,000

Car loan: $1000

Credit cards: $1000

Cross income: $12,000

Bob's total monthly debt payment is $4,000

$4,000= $2,000 + $1000 + $1000

Bob’s DTI Ratio is 0.33

0.33 = $4,000 ÷ $12,000

Converting it to Percentage, Bob has a 33% debt-to-income ratio.

Hello there! Let’s get started with your mortgage.

Our goal is to help as many people as possible become homeowners. It is an honor to be a part of such milestone in the lives of our customers.

Other Topics

The internet has increased people's understanding of the long-term advantages of saving and investing. Even at such a young age, some people have developed impressive stock market holdings. Nonetheless, there are others who think that investing is limited to the stock market alone. Real Estate can also be discussed. Some financial experts and economists argue that Real Estate is a safer long-term investment than the Stocks Market.